Tax advantage rates on “ordinary income” are higher than those that apply to much of your investment income. Ordinary income generally includes salary, income from self-employment or business activities, interest, and distributions from tax- deferred retirement accounts. Some of it may also be subject to payroll tax, or you may have to pay the alternative minimum tax (AMT), under which different tax rates apply. This is why careful planning for ordinary income and deductible expenses continues to be important.

Timing Income and Expenses

Smart timing of income and expenses can reduce your tax liability, and poor timing can unnecessarily increase it. When you don’t expect to be subject to the AMT in the current year or the next year, deferring income to the next year and accelerating deductible expenses into the current year may be a good idea. Why? Because it will defer tax, which usually is beneficial.

But when you expect to be in a higher tax bracket next year — or you expect tax rates to rise — the opposite approach may be beneficial: Accelerating income will allow more income to be taxed at your current year’s lower rate. And deferring expenses will make the deductions more valuable, because deductions save more tax when you’re subject to a higher tax rate.

Whatever the reason behind your desire to time income and expenses, you may be able to control timing of these income items:

- Bonuses,

- Consulting or other self employment income,

- U.S. Treasury bill income, and

- Retirement plan distributions, to the extent they won’t be subject to early-withdrawal penalties and aren’t required.

Some expenses with potentially controllable timing are mortgage interest, investment interest expense and charitable contributions.

Impact of the TCJA on Timing Strategies

The TCJA has made timing income and deductions more challenging because some strategies that tax- payers used to implement no longer are making sense. Here’s a look and some significant changes that have affected deductions:

Reduced deduction for state and local tax.

Property tax used to be a popular expense to time. But with the TCJA’s limit on the state and local tax deduction, property tax timing will likely provide little, if any, benefit for higher-income taxpayers. If you reside in a state with no, or low, income tax, this change might be less relevant. But keep in mind that deducting sales tax instead of income tax may be beneficial, especially if you purchased a major item, such as a car or boat.

Suspension of miscellaneous itemized deductions subject to the 2% floor. This deduction for expenses such as certain professional fees, investment expenses and unreimbursed employee business expenses is suspended through 2025. While this eliminates the home office deduction for employees who work from home (even if your employer has required it during the pandemic), if you’re self-employed, you may still be able to deduct home office expenses.

More-restricted personal casualty and theft loss deduction. Through 2025, this itemized deduction is suspended except if the loss was due to an event officially declared a disaster by the President.

Increased standard deduction. The TCJA nearly doubled the standard deduction. While many higher-income taxpayers will still benefit from itemizing, some — such as those in low-tax states, who don’t have mortgages or who aren’t charitably inclined — may now save more tax by claiming the standard deduction.

Tax-Advantaged Saving for Health Care

If medical expenses not paid via tax-advantaged accounts or reimbursable by insurance exceed a certain percentage of your adjusted gross income (AGI), you can claim an itemized deduction for the amount exceeding that “floor.” This floor can be difficult for higher-income taxpayers to exceed.

The TCJA had reduced the floor from 10% to 7.5% for 2017 and 2018, and last year the 7.5% floor was extended to 2019 and 2020. But it will return to 10% for 2021 unless Congress extends the lower floor again. (Check with your IMC tax advisor for the latest information.)

Eligible expenses may include health insurance premiums, long-term-care insurance premiums (limits apply), medical and dental services, and prescription drugs. Mileage driven for health care pur- poses also can be deducted — at 17 cents per mile for 2020.

Consider bunching elective medical procedures (and any other services and purchases whose timing you can control without negatively affecting your or your family’s health) into alternating years if it would help you exceed the applicable floor and you’d have enough total itemized deductions to benefit from itemizing.

If one spouse has high medical expenses and a relatively lower AGI, filing separately may allow that spouse to exceed the AGI floor and deduct some medical expenses that wouldn’t be deductible if the couple filed jointly.

Warning: Because the AMT exemption for separate returns is considerably lower than the exemption for joint returns, filing separately to exceed the floor could trigger the AMT.

You may be able to save taxes without having to worry about the medical expense deduction floor by contributing to one of these accounts:

HSA. If you’re covered by a qualified high deductible health plan, you can contribute pretax income to an employer-sponsored Health Savings Account — or make deductible contributions to an HSA you set up yourself — up to $3,550 for self-only coverage and $7,100 for family coverage for 2020 (plus $1,000 if you’re age 55 or older). HSAs can bear interest or be invested, growing tax-deferred similar to an IRA. Withdrawals for qualified medical expenses are tax-free, and you can carry over a balance from year to year.

FSA. You can redirect pretax income to an employer-sponsored Flexible Spending Account up to an employer-determined limit — not to exceed $2,750 in 2020. The plan pays or reimburses you for qualified medical expenses. What you don’t use by the plan year’s end, you generally lose — though your plan might allow you to roll over up to $550 to 2021. Or it might give you a 2½-month grace period to incur expenses to use up the previous year’s contribution. In response to the COVID-19 crisis, the IRS has temporarily made FSAs a little more flexible. If you have an HSA, your FSA is limited to funding certain permitted expenses.

Smaller AMT Threat

The top AMT rate is 28%, compared to the top regular ordinary-income tax rate of 37%. But the AMT rate typically applies to a higher taxable income base. You must pay the AMT if your AMT liability exceeds your regular tax liability.

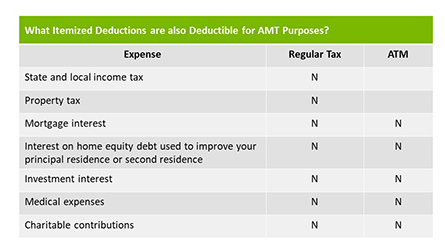

The TCJA substantially increases the AMT exemptions through 2025. This means fewer taxpayers will have to pay the AMT. In addition, deductions used to calculate regular tax that aren’t allowed under the AMT can trigger AMT liability, and there aren’t as many differences between what’s deductible for AMT purposes and regular tax purposes. This also reduces AMT risk. However, AMT will remain a threat for some higher-income taxpayers.

So before timing your income and expenses, determine whether you’re already likely to be subject to the AMT — or whether the actions you’re considering might trigger it. In addition to deduction differences, some income items might trigger or increase AMT liability:

- Long-term capital gains and qualified dividend income,

- Accelerated depreciation adjustments and related gain or loss differences when assets are sold, and

- Tax-exempt interest on certain private-activity municipal bonds.

Finally, in certain situations exercising incentive stock options (ISOs) can trigger significant AMT liability.

Avoiding or Reducing AMT

With proper planning, you may be able to avoid the AMT, reduce its impact or even take advantage of its lower maximum rate:

If you could be subject to the AMT this year … consider accelerating income into this year, which may allow you to benefit from the lower maximum AMT rate. And deferring expenses you can’t deduct for AMT purposes may allow you to preserve those deductions (but watch out for the annual limit on the state and local tax deduction). If you also defer expenses you can deduct for AMT purposes, the deductions may become more valuable because of the higher maximum regular tax rate. Finally, carefully consider the tax consequences of exercising ISOs.

If you could be subject to the AMT next year … consider taking the opposite approach. For instance, defer income to next year, because you’ll likely pay a relatively lower AMT rate. Also, before year end consider selling any private-activity municipal bonds whose interest could be subject to the AMT. Also be aware that, in certain circumstances, you may be entitled to an AMT credit.

Payroll Taxes

In addition to income tax, you must pay Social Security and Medicare taxes on earned income, such as salary and bonuses. The 12.4% Social Security tax applies only up to the Social Security wage base of $137,700 for 2020. All earned income is subject to the 2.9% Medicare tax. Both taxes are split equally between the employee and the employer.

Also, an Aug. 8 presidential memorandum offers a deferral of the employee share of Social Security taxes, but those earning $4,000 or more per biweekly pay period aren’t eligible. As of this writing, there are many open questions about the deferral. Contact your IMC tax advisor for the latest information.

Self-Employment Taxes

If you’re self-employed, you pay both the employee and employer portions of payroll taxes on your self-employment income. The employer portion (6.2% for Social Security tax and 1.45% for Medicare tax) is deductible above the line. You also may be eligible for some COVID-19 payroll tax relief.

As a self-employed taxpayer, you may benefit from other above-the-line deductions as well. You can deduct 100% of health insurance costs for yourself, your spouse and your dependents, up to your net self-employment income. You also can deduct contributions to a retirement plan and, if you’re eligible, an HSA for yourself. And you might be able to deduct home office expenses. Above-the-line deductions are particularly valuable because they reduce your AGI and, depending on the specific deduction, your modified AGI (MAGI), which are the triggers for certain additional taxes and the phaseouts of many tax breaks.

Additional 0.9% Medicare Tax

Another payroll tax that higher- income taxpayers must be aware of is the additional 0.9% Medicare tax. It applies to FICA wages and net self-employment income exceeding $200,000 per year ($250,000 if married filing jointly and $125,000 if married filing separately).

If your wages or self-employment income varies significantly from year to year or you’re nearing the threshold for triggering the additional Medicare tax, income timing strategies may help you avoid or minimize it. For example, if you’re an employee, perhaps you can time when you receive a bonus or exercise stock options. If you’re self-employed, you may have flexibility on when you purchase new equipment or invoice customers. If you’re an S corporation shareholder-employee, you might save tax by adjusting how much you receive as salary vs. distributions.

Also consider the withholding rules. Employers must withhold the addi- tional tax beginning in the pay period when wages exceed $200,000 for the calendar year — without regard to an employee’s filing status or income from other sources. So your employer might withhold the tax even if you aren’t liable for it — or it might not withhold the tax even though you are liable for it.

If you don’t owe the tax but your employer is withholding it, you can claim a credit on your 2020 income tax return. If you do owe the tax but your employer isn’t withholding it, consider filing a W-4 form to request additional income tax withholding, which can be used to cover the shortfall and avoid interest and penalties. Or you can make estimated tax payments.

Owner-Employees

There are special considerations if you’re a business owner who also works in the business, depending on its structure:

Partnerships and Limited Liability Companies. Generally, all trade or business income that flows through to you for income tax purposes is subject to self-employment taxes — even if the income isn’t distributed to you. But such income may not be subject to self-employment taxes if you’re a limited partner or the LLC member equivalent. Check with your IMC tax advisor on whether the additional 0.9% Medicare tax on earned income or the 3.8% NIIT will apply.

S Corporations. Only income you receive as salary is subject to payroll taxes and, if applicable, the 0.9% Medicare tax. To reduce these taxes, you may want to keep your salary relatively — but not unreasonably — low and increase the income that is taxed to you through your Schedule K-1 by virtue of your share of the earnings from the business. That income isn’t subject to the corporate level tax or the 0.9% Medicare tax and, typically, is not subject to the 3.8% NIIT.

C Corporations. Only income you receive as salary is subject to payroll taxes and, if applicable, the 0.9% Medicare tax. Nonetheless, you may prefer to take more income as salary (which is deductible at the corporate level) as opposed to dividends (which aren’t deductible at the corporate level yet are still taxed at the shareholder level and could be subject to the 3.8% NIIT) if the overall tax paid by both the corporation and you would be less.

Warning: The IRS scrutinizes corporate payments to shareholder-employees for possible misclassification, so tread carefully.

Estimated Payments and Withholding

You can be subject to penalties if you don’t pay enough tax during the year through estimated tax payments and withholding. Here are some strategies to help avoid underpayment penalties:

Know the minimum payment rules. For you to avoid penalties, your estimated payments and withholding must equal at least 90% of your tax liability for 2020 or 110% of your 2019 tax (100% if your 2019 AGI was $150,000 or less or, if married filing separately, $75,000 or less).

Use the annualized income installment method. This method often benefits taxpayers who have large variability in income from month to month due to bonuses, investment gains and losses, or seasonal income (at least if it’s skewed toward the end of the year). Annualizing computes the tax due based on income, gains, losses and deductions through each estimated tax period.

Estimate your tax liability and increase withholding. If you determine you’ve underpaid, consider having the tax shortfall withheld from your salary or year end bonus by Dec. 31. Because withholding is considered to have been paid ratably throughout the year, this is often a better strategy than making up the difference with an increased quarterly tax payment, which may still leave you exposed to penalties for earlier quarters.